The Perks of Being a Dinosaur

May 25, 2021“What has been will be again,

what has been done will be done again;

there is nothing new under the sun.”

Ecclesiastes 1:9

I have been called a lot of names lately on Twitter. Some are even laced with profanities (which I block immediately.) But for the most part, I chuckle and let it go. It all started when I decided to take on Michael Saylor in a debate over Bitcoin versus gold. Saylor is one of the biggest proponents of Bitcoin out there - if not the biggest. I summarized our debate in a recent post. The debate got a lot of traction and kicked off a fierce Twitter battle between the Bitcoin believers and the apostates who still believe in gold as a store of value. The opinions on Bitcoin are mostly binary in nature. There are lovers and haters. It’s likely here to stay until, perhaps, a new and better technology comes along. But at what value? Only time will tell.

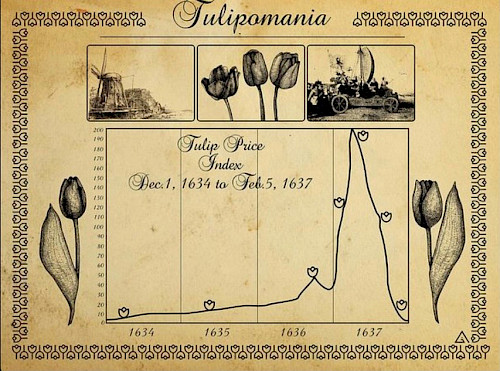

But the Bitcoin debate raises another much more important issue which has concerned me for a number of years: That we may be witnessing a financial bubble that will eventually burst and lead us into another financial crisis. And make no mistake, the next crisis will lead to a depression far more severe than the Great Recession of 2007 - 2009.

But the Bitcoin debate raises another much more important issue which has concerned me for a number of years: That we may be witnessing a financial bubble that will eventually burst and lead us into another financial crisis. And make no mistake, the next crisis will lead to a depression far more severe than the Great Recession of 2007 - 2009.

I am not alone in my concern. There are a number of very smart people issuing the same warning. But we’re outnumbered by much louder voices emanating from Wall Street, the mainstream media and more importantly in recent years, the internet. The euphoria driving up prices of cryptocurrencies, tech stocks, SPACs or the next GameStop Corp. that captures the imagination of the millions of Robin Hood traders is at a fever pitch. The current sentiment in the financial markets is starting to have a familiar ring to it.

Which brings me back to the name-calling.

The Bitcoiners and several tech stock players are undoubtedly deriving pleasure from declaring I am too old to understand that this time, it’s different. I just don’t get that the world has changed and the previous rules that have governed markets throughout the centuries no longer apply. They troll me with taunts like, “Have fun staying poor, boomer” and “ Isn’t it past your bedtime, old man”. And my personal favourite (complete with memes),“You are a dinosaur “.

The dinosaur taunt is hardly new. I was called the same thing at the height of the dot-com bubble during the late 90’s when I had the temerity to question the insane valuations being attributed to equities during that bubble. I recall a dinner with a group of tech investors, where I made an off-handed comment that I couldn’t get my head around the valuations being assigned to these companies by analysts from big Wall Street firms. By the reaction you would have thought I had committed all seven deadly sins in one utterance. It was the first time I had been called a dinosaur (I was in my 40s!), but not the first time I had witnessed irrational exuberance and a subsequent crash.

I started my career on a trading desk at Merrill Lynch in 1978. U.S. equities had been in a nine year brutal bear market that still had four more years to go. But any company that was in precious metals or oil was in the beginnings of an incredible bull run that ultimately lasted until 1981. As we got closer to the peak, I was privileged to witness the height of stupidity. The valuations being attributed to companies that had zero value (much like the dot-com stocks) were through the roof. Investors were bidding up share prices based on rumours and fairy tales. They convinced themselves that the price of gold and oil would go up forever. You could do no wrong. Throw a dart at anything on the move and you were sure to make money. It’s much like the cryptocurrency space today. And when it ended, it ended suddenly and with little warning. Most of the share prices eventually wound their way to their intrinsic value, which is to say, zero.

I have lived through several other similar experiences, including the 1987 crash and more recently the 2008 financial crisis. Each crash was preceded by the same belief that “this time it’s different“. Sadly, history proves that these things are never different.

A book worth reading is, “This Time Is Different: Eight Centuries of Financial Folly”, by Carmen M. Reinhart & Kenneth S. Rogoff. The authors make my point perfectly clear. Throughout history, rich and poor countries alike have been lending, borrowing, crashing - and recovering - their way through an extraordinary range of financial crises. Each time the experts have chimed, "this time is different", claiming that the old rules of valuation no longer apply and the new situation bears little similarity to past disasters. A great example is from the 1920s, when the bankers and economists predicted that wars would not reoccur, the future would be stable and markets had reached a permanent plateau. Of course, history proved them dead wrong.

Don’t be fooled by following the advice of experts, either. Otherwise-savvy people ignore the telltale signs of a bubble when they are in the grasp of “this time is different” syndrome. Think back to the brilliant Federal Reserve Chair Alan Greenspan, who started the loose monetary policy that created the current mess we are now in. Or any Fed Chair since. They wouldn’t recognize a bubble if it stood on a table in ladies underwear and sang “Happy Bubbles Are Here Again”. They all have a perfect score for getting it wrong. And that goes for Wall Street economists and analysts. They are paid to keep the game going. When a sector goes bust, they just move on to the next one. If the entire system goes bust, they plead for government bailouts. And they get them.

But the biggest spreader of misinformation is the internet. True, there is a lot of great content on the internet that gives solid, unbiased advice you won’t get from Wall Street firms. But there are many more garbage ideas being peddled by all kinds of charlatans, with huge followings. You only need to read the comments under each of their postings to get a clear picture of how cult-like a lot of the language is becoming. Wild exaggerations and conspiracies are littered everywhere. All the signs of a bubble begging to be pricked are screaming out at us. Somewhere, there is a pin waiting for the right moment to come along and burst it.

A bit of free advice to all my readers: Youth is not an accomplishment. Wisdom comes from experience.

Regards,

An Old Dinosaur

P.S. I recently watched an interview on Kitco with market strategist Chris Vermeulen, in which he showed a chart that depicted where he thinks we are in this market cycle. The commentary that came with it is hilarious and spot on. He nailed it. My three favourite stages were:

1) Euphoria - “I am a genius. We’re all going to be rich.”

2) Anger - “Why did the government allow this to happen?”

3) Depression - “My retirement money is lost. I am an idiot.”

Be safe out there.

Also published in The Toronto Star